I was reading this article in today’s Wall Street Journal, Online Edition and was struck by some of the conflicting messages it highlights for many. I am a student of financial markets and to some extend the Federal Reserve (the “Fed”), so I have a certain perspective on the whole subprime mortgage debacle that is no secret to anyone reading my column. I object to bailouts, whether it be for homeowners or Wall Street, and I have been writing that opinion since last October when I first started publishing my blog. But this article got me thinking about these Philadelphia residents who are being evicted from their homes because they can’t pay their mortgages. Circumstances have now changed, and they have changed because the Fed, no doubt with the blessing of Treasury, has bailed out Wall Street. (For more on this there is another article in today’s Wall Street Journal Online expressing one Federal Reserve Bank President’s concerns about the Fed’s recent actions and the market distortions that can be expected as a result.)

Admittedly bailing out Wall Street is good, in some ways, for everyone as it lessens the risk of a major economic blowup. But tell that to a resident in Philadelphia being evicted from their home who can understandably be thinking “they can bail out those Wall Street executives and their customers but they can’t help me?” Enter the Sheriff, John Green:

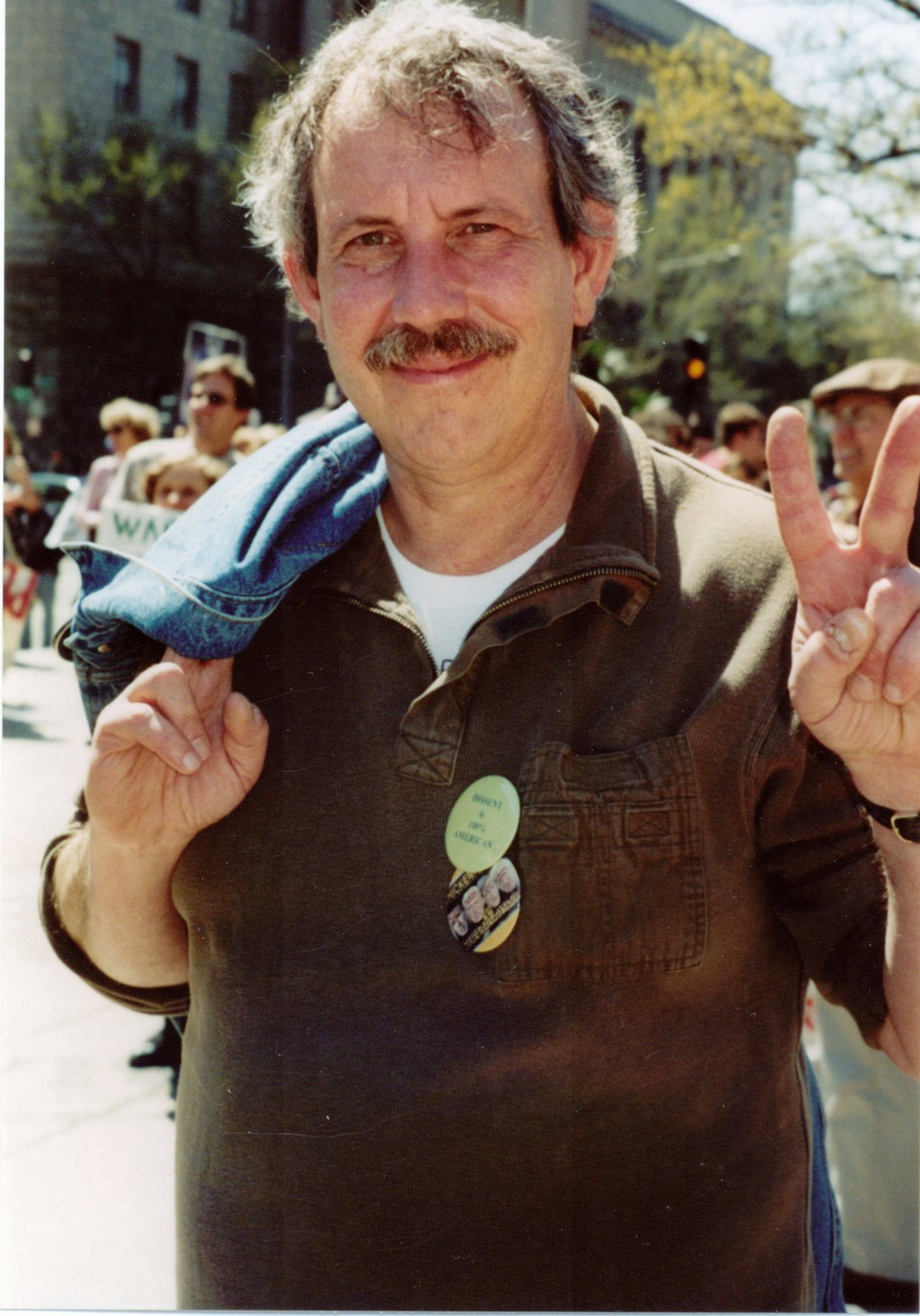

Sheriff John Green has spent 37 years in law enforcement. But these days he's best known around town for the law he won't enforce.

With the economy soft and thousands of Philadelphians delinquent on their mortgages, Sheriff Green this spring refused to hold a court-ordered foreclosure auction. His move raised eyebrows on the bench and dropped jaws among lenders and their attorneys, who accuse him of shirking his duty to enforce legal contracts….

Mortgage lenders, servicers and their attorneys thought Mr. Green was acting more Robin Hood than sheriff. "It's not his job to postpone things in favor of certain people," says Michael VanBuskirk, a Philadelphia attorney, who describes the city as a "legal free-fire zone." The city, he says, is "less attractive to business if you can't be certain that the sheriff won't invalidate a contract."

Fed policies to help rescue Wall Street firms have created distortions that have hurt many innocent bystanders in this debacle as savings rates plummet and inflation increases. In fact, the inflation in food and energy prices caused in large measure by negative real interest rates is likely a direct cause of many of the foreclosures as those consumers most at risk can no longer afford to pay all of their bills. So in keeping real interest rates negative to rescue the financial industry Fed policies are hurting many of those who would be hurt in a larger financial collapse anyway and the impact is falling disproportionately to the most vulnerable among us. To hear mortgage lenders now object to the Sheriff’s actions because they favor one group over another is, in my opinion, entertaining at best. In my view, looking to the public policy issues behind this story presents a very different picture than a simple issue of contract law.

I believe we are witnessing the spread of the bailout mentality that has been established by the Fed (and sanctioned by the Administration) in favor of Wall Street. Regardless of the ultimate consequences of allowing major Wall Street firms to fail, the general public will understandably view these actions as favoring those on Wall Street as opposed to them. Let’s do a thought experiment. The first part is to ask: “Why is it good for the Fed to bail out these Wall Street firms by providing credit at taxpayer risk?” The answer, of course, is that to do so will help avoid an economic collapse that would hurt everyone. The second part is to ask: “Why should the Sheriff refuse to sell foreclosed homes at auction?” The answer, of course, is that doing so helps avoid an economic collapse of the neighborhoods involved that would hurt everyone. So, is the Sheriff acting like Robin Hood or following the example set by the Fed? In the eyes of those on the ground I think taking the latter view is easily comprehensible.

The distortions caused by the Fed’s bailout of years of negligent lending activities by Wall Street and all of its subsidiary tentacles has set the stage for redistribution fights such as this one, and I don’t know how you put this genie back in the bottle. So at the end of this piece I have an unanswered question: Is the creativity demonstrated by Mr. Bernanke, with the certain blessings of Mr. Paulson, good for our society in the long run or just another example of how being too creative (ever heard of a CDO squared?) can really mess things up? Sphere: Related Content

2 comments:

Entertaining. None of this would occur with a solid and stable currency base which could not be manipulated, and therefore, loans would be carefully considered prior to their issuance.

Irrational exuberance fueled by expansionary monetary policy allowed this bonanza in the real estate market to occur. I wonder whats the total value of mortgages outstanding, and what percent it represents in comparison to the nations' monetary supply? I am watching in glee as market prices fall to finally allow myself, a man who lives within his means, to actually buy a house.

That is one advantage of this mess - it brings asset prices back to earth.

Post a Comment